In the rapidly evolving world of finance, Islamic Forex trading has emerged as a significant area of interest for many investors. Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their values. However, for Muslim traders, engaging in Forex trading must align with the principles of Shariah, the Islamic law that governs various aspects of a Muslim’s life.

Understanding the nuances of Islamic Forex trading is crucial for ethical and responsible trading practices. In this article, we will delve into the core principles of Islamic Forex trading, the importance of Shariah compliance, risks associated with trading, and effective strategies that can guide you in your trading journey. For more detailed insights, visit islamic forex trading https://tradingarea-ng.com/.

Understanding Islamic Forex Trading

Islamic Forex trading refers to currency trading that adheres to Islamic principles. The fundamental principles that govern finance in Islam are derived from the Quran and Hadith. The primary tenets revolve around the prohibition of Riba (interest), Gharar (excessive uncertainty), and Maysir (gambling). Hence, Islamic Forex trading must avoid these elements to be considered Halal (permissible).

The Importance of Shariah Compliance

Shariah compliance is not merely a suggestion but a requirement for Muslims participating in Forex trading. Adhering to these principles ensures that the trading practices are ethical and do not promote injustice or exploitation. To engage in Islamic Forex trading, investors must select brokers who offer Shariah-compliant accounts, which do not involve the payment or receipt of interest on overnight positions—also known as swaps.

The Prohibition of Riba

Riba, or usury, is strictly prohibited in Islam. In traditional Forex trading, brokers often apply interest on overnight positions, leading to Riba. Islamic Forex accounts eliminate this concern by not charging or paying interest. Instead, these accounts operate based on a system that ensures compliance with Islamic law, offering a way for Muslim traders to access the Forex market without conflicting with their beliefs.

The Risk of Gharar

Gharar refers to excessive uncertainty or ambiguity in contracts, which Islam seeks to avoid. In the context of Forex trading, it is crucial to understand the risks and intricacies involved. Traders should adopt strategies that are clear and transparent, ensuring that every aspect of the trade is well understood before proceeding. Engaging in speculative or highly uncertain trades can lead to Gharar and should be strictly avoided.

Maysir: Avoiding Gambling Practices

Maysir, or gambling, is forbidden in Islam as it promotes dependency on chance rather than skill and effort. In Forex trading, this translates to avoiding high-risk trading strategies that resemble gambling. Traders must rely on well-researched strategies, focusing on analysis and economic fundamentals, to inform their decisions rather than luck.

Choosing the Right Broker

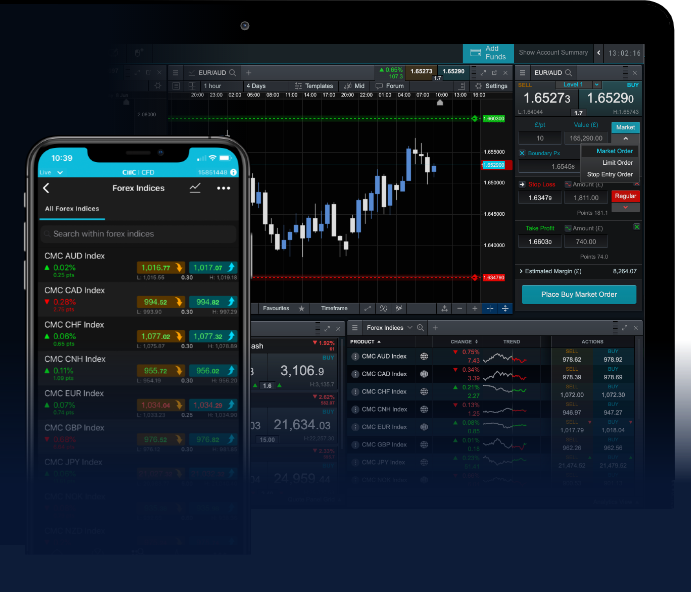

Selecting the right broker is vital for engaging in Islamic Forex trading. An ideal broker should offer services tailored to comply with Shariah law. Features to look for include:

- Islamic accounts with no swap fees.

- Transparency in pricing and execution.

- A range of currency pairs to trade.

- Access to reliable market analysis and research tools.

It’s crucial to conduct thorough research into each broker’s practices to ensure they align with your trading principles.

Trading Strategies for Islamic Forex Trading

Islamic Forex trading is not only about compliance but also involves strategic planning. Here are some essential strategies that can enhance your trading success:

1. Fundamental Analysis

Understanding economic indicators and news impacts on currency pairs is essential. Fundamental analysis enables traders to make informed decisions based on economic health, interest rates, and geopolitical events.

2. Technical Analysis

Using charts and indicators to identify trends and patterns can significantly assist in making trading decisions. This approach minimizes feelings of uncertainty and helps mitigate risks.

3. Risk Management

Implementing strong risk management strategies is imperative. Traders should set stop-loss orders, limit the size of their investments, and diversify their portfolios to manage risk effectively. The principle of safeguarding capital allows traders to remain in the market for the long term.

4. Trading Psychology

Staying centered and avoiding emotional decisions is crucial for successful trading. Relying on predetermined strategies and adhering to a trading plan can help traders avoid the pitfalls of impulsive actions.

Conclusion

Islamic Forex trading offers a viable avenue for Muslim investors to engage in global financial markets while adhering to their religious principles. By understanding and applying the tenets of Shariah law, traders can navigate the complexities of Forex trading ethically. The importance of selecting the right broker, employing sound trading strategies, and maintaining a solid risk management approach cannot be overstated. As the market continues to evolve, staying informed and mindful of ethical practices will empower traders to participate in Forex trading without compromising their values. Ultimately, Islamic Forex trading serves not only as a source of income but as a means to reflect the principles of justice, fairness, and respect that underpin Islamic finance.